Retail investors scooped up these 5 stocks in July

President Trump touts stock gains following executive action on COVID relief, abruptly ends news conference

President Trump escorted from news conference after shots were fired near the White House.

Retail investors joined the throngs of buyers taking advantage of a July market rally, according to TD Ameritrade, but they were far from indiscriminate.

Continue Reading Below

The company’s Investor Movement Index, a proprietary, behavior-based index, rose 1.76% to 4.63, a moderately small increase compared with historical norms. The index, which traded near 2.1 at the beginning of 2020, reached an all-time high of more than 8 in late 2017.

“The media narrative seems to have been that retail traders are out just buying stocks willy-nilly,” J.J. Kinahan, chief market strategist at online broker TD Ameritrade, told FOX Business. “The primary thing that the data shows is that, yes, our clients have continued to increase their exposure to the market since March, but they're doing so in a very measured fashion.”

TRUMP'S EXECUTIVE ORDERS GIVE CONGRESS NEW DEADLINE: GOLDMAN SACHS

The deliberate approach from TD clients came as the benchmark S&P 500 climbed 5.51% during July amid optimism surrounding the reopening of the economy despite a resurgence in new COVID-19 infections. Investor sentiment was also supported by promises the Federal Reserve will keep interest rates near zero for the foreseeable future.

TD investors gravitated towards information technology and health-care companies during the month as the Nasdaq set record high after record high and researchers raced to develop a COVID-19 vaccine.

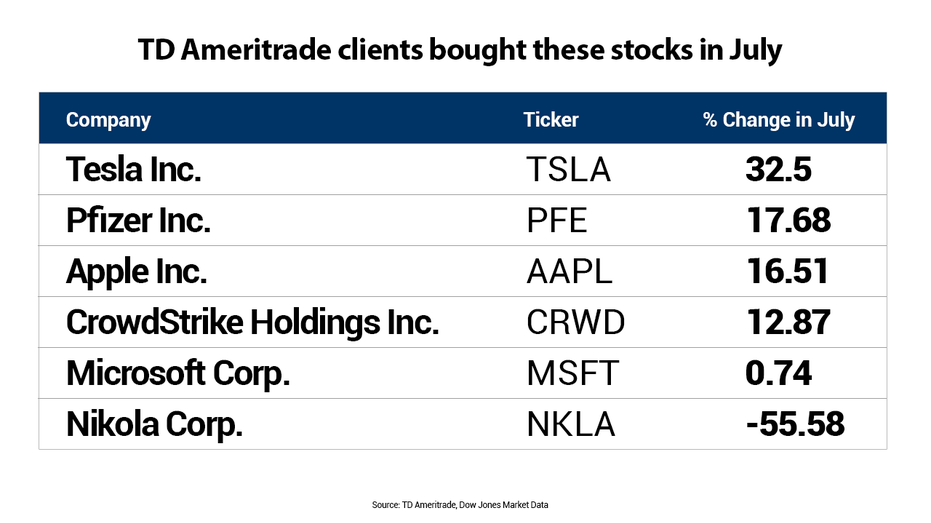

Favorite stocks included Tesla Inc., Apple Inc., Microsoft Corp., Nikola Corp., Crowdstrike Holdings Inc. and Pfizer Inc.

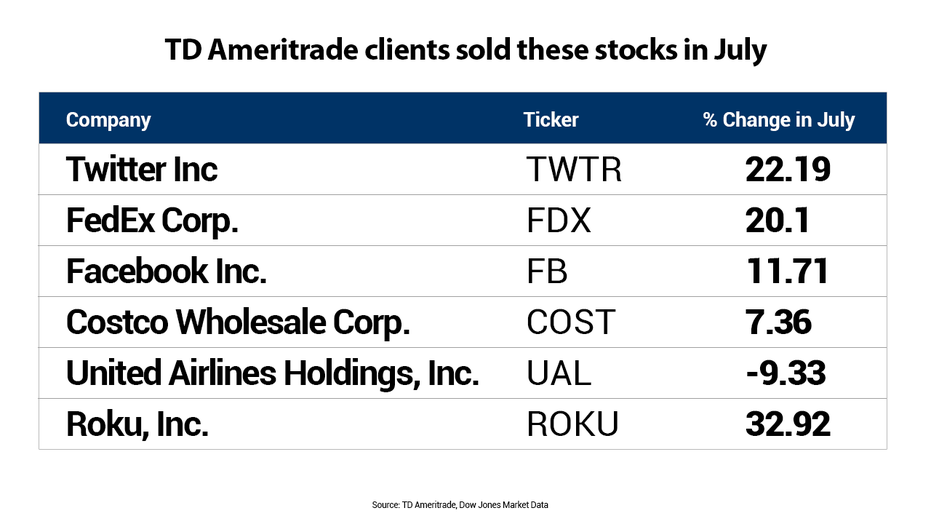

“The interesting thing to me about Tesla is our clients, when it got down to $500 or $600, were buyers,” Kinahan said. "When it got up to $800 or $900, they were sellers.” CLICK HERE TO READ MORE ON FOX BUSINESS TD clients also took the opportunity to sell some of the names, including Facebook and United Airlines, that had “nice runs” up in March or April, according to Kinahan. Facebook grappled with advertisers pulling ads after complaints that the social media giant failed to adequately police hate speech, while United faced uncertainty from prospective passengers due to the surge in COVID-19 cases. Other names on the “net sell” list were Twitter Inc., FedEx Corp., Costco Wholesale Corp. and Roku, Inc. TD Ameritrade does not provide data about the size of net changes in shares bought or sold.

Source: Read Full Article