Hurting financially during the COVID-19 crisis? 3 tax breaks that can help

Treasury considering additional stimulus checks if ‘need is still there’: Monica Crowley

Treasury Department spokesperson Monica Crowley on coronavirus stimulus and potential U.S. tariffs on the E.U. and the U.K.

Lowering your tax burden is a smart thing to do every year. But right now, it may be more important than ever. With the U.S. economy in a recession and millions of Americans grappling with income insecurity resulting from the COVID-19 crisis, it's important to capitalize on as many tax breaks as you can. If you've yet to file your 2019 taxes, here are a few important credits it pays to look into as you prepare that return.

Continue Reading Below

THE IRS SAYS CORONAVIRUS ECONOMIC IMPACT PAYMENTS CAN BE SEIZED FOR THIS REASON

1. The Earned Income Tax Credit

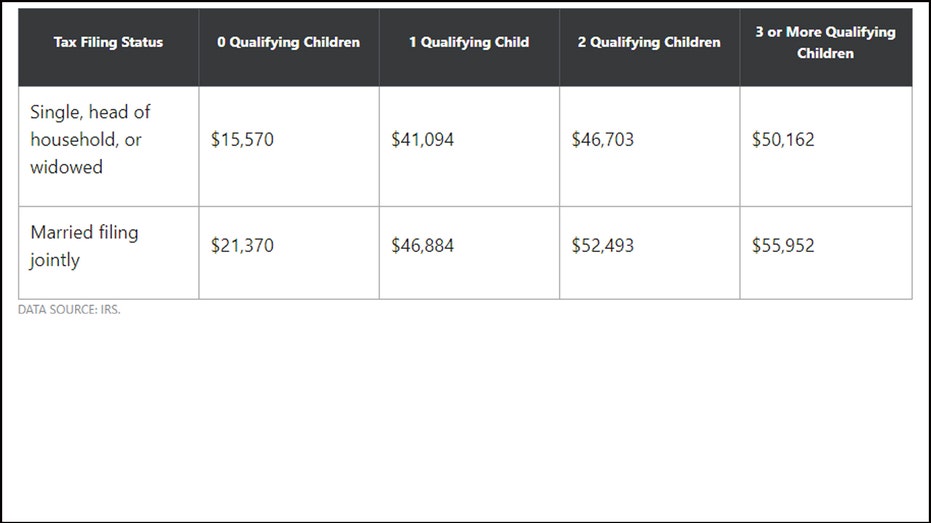

The Earned Income Tax Credit, or EITC, can serve as a lifeline for lower-income households. To qualify, your tax-filing status cannot be married filing separately, and you can't have investment income from last year in excess of $3,600. From there, you can consult this table to see if you qualify for the credit:

Assuming you do qualify, this is what the EITC may be worth to you: GOT YOUR STIMULUS CHECK BUT NOT YOUR TAX REFUND? IRS SAYS TO EXPECT DELAYS Best of all, the EITC is refundable, so that if it lowers your tax liability to less than $0, the IRS will pay you the difference. Since unemployment has been hitting lower-income households the hardest during the COVID-19 crisis, it's imperative that you snag this credit if you're eligible. If you have children in your household under the age of 17, you may have received additional stimulus cash for them when relief payments went out earlier this year. The good news is that those same children can also score you up to $2,000 apiece on your upcoming tax return. That $2,000 will be yours to claim in full if your income doesn't exceed $200,000 as a single tax filer, or $400,000 as a married couple filing jointly. WHAT IS THE CHILD TAX CREDIT? These thresholds are much higher than the thresholds at which stimulus payments phased out, so if you got a stimulus check, there's a good chance you'll be in the clear to claim the Child Tax Credit, too. Furthermore, up to $1,400 per child of the credit is refundable so that if your tax liability is below $0, the IRS will send you that cash. If you paid for child care last year so you could work, you may be entitled to some extra money back on your next tax return. The Child and Dependent Care Credit allows you to claim between 20% and 35% of up to $3,000 in child care costs for a single child under age 13, or up to $6,000 in child care costs for two or more children under 13. The specific percentage you can claim will hinge on your income level, and the most this credit can be worth is $1,200 (20% of a $6,000 child care bill). Still, claiming it would essentially be akin to getting a follow-up $1,200 stimulus check, so it's worth seeing if you qualify. GET FOX BUSINESS ON THE GO BY CLICKING HERE Though filing taxes may be a time-consuming prospect, doing so strategically could also put more money in your pocket. And at a time like this, that's an extremely important thing to do. You have until July 15 to submit your 2019 taxes, so get moving on that return if you haven't gotten started already. GET FOX BUSINESS ON THE GO BY CLICKING HERE Source: Read Full Article

2. The Child Tax Credit

3. The Child and Dependent Care Credit